Insurers, underwriters and marine engineers must adapt to climate change by embedding climate science into risk models, incentivising resilience and supporting infrastructure upgrades.

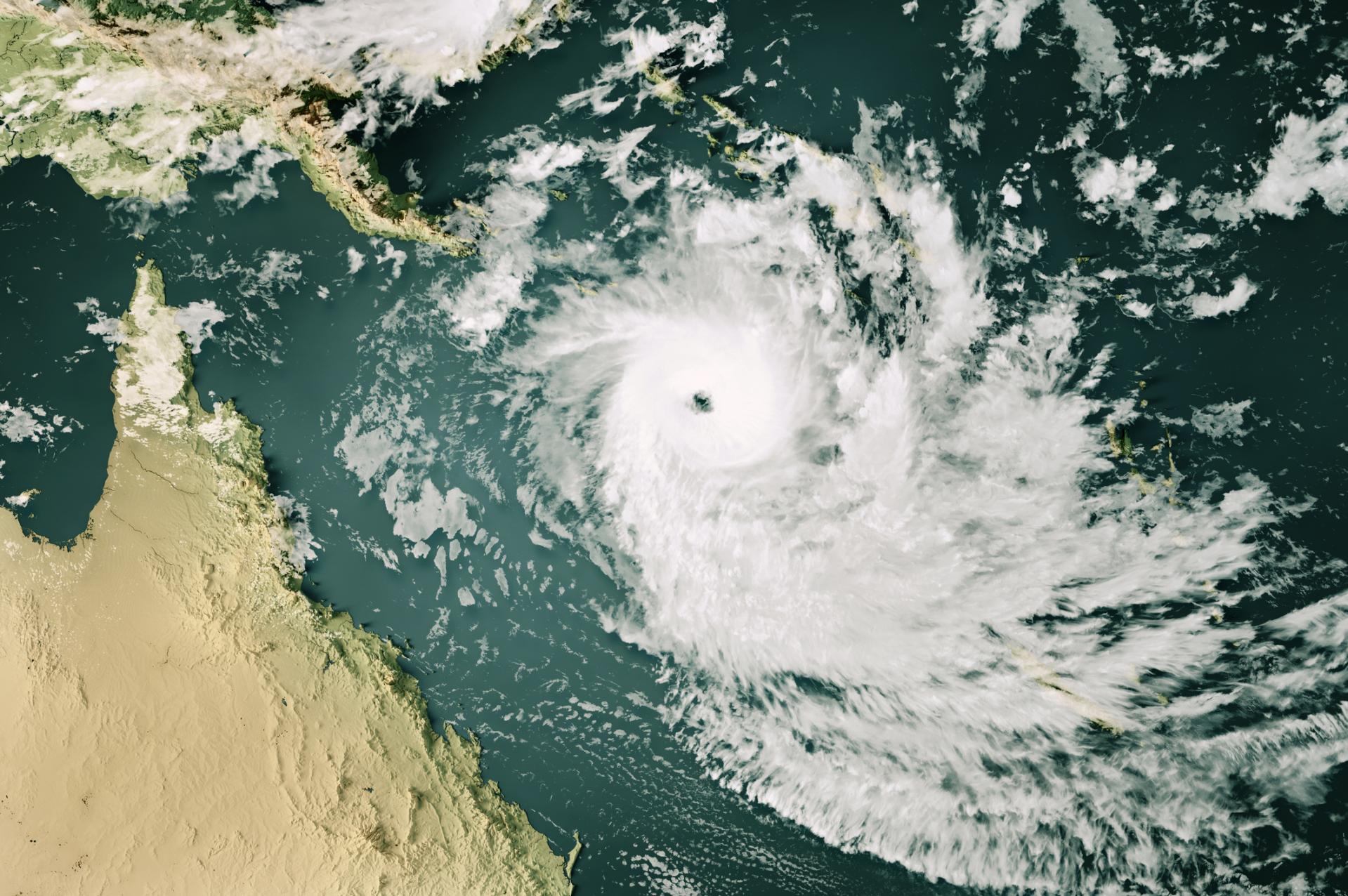

The Asia Pacific (APAC) region's maritime sector has been impacted by two growing climate trends: worsening weather disruptions and the lure of Arctic shipping routes.

With densely populated coastlines, vital global trade routes and increasing exposure to extreme weather, the region faces complex and growing risks. For the marine insurance industry, the consequences are already evident: port closures, cargo delays, infrastructure damage and rising claims.

As climate change intensifies, so does the urgency for insurers to reassess traditional models and adopt innovative strategies that can both mitigate losses and build long-term resilience.

Operational risks

There has been a rise in the frequency and severity of climate-related disasters impacting APAC, with Asia heating up faster than the global average.

Monsoons, tropical cyclones and heatwaves are only some of the weather events impacting the ports and shipyards in the region, subjecting them to new risks and impacting the protection of machinery and the safety of storage.

Torrential monsoon rains are overwhelming drainage systems at key ports in countries such as India, Bangladesh and China. These floods have caused widespread equipment failure, downtime and cargo damage.

Prospects and perils

Global warming has caused the Arctic to melt at a rapid pace, allowing the Northern Sea Route (NSR) to become a viable alternative to the Suez Canal, reducing transit distances between Asia and Europe by up to 40%.

NSR traffic reached a record high in 2024, growing to nearly 38 million tonnes, a tenfold increase since 2014.

China is advancing the Polar Silk Road initiative, while Japan, South Korea and Singapore are exploring Arctic shipping viability through separate national and regional efforts.

Despite the rising temperatures, significant hazards in the Arctic persist. Navigation continues to be challenged by polar storms, floating ice and poor visibility. The route lacks infrastructure and emergency response capability to handle such risks, while communication blackouts and scarcity of port services can turn minor incidents into crises.

To mitigate such risks, there are safety regulations imposed by the International Maritime Organisation on those using the passage, including mandatory ice-class vessels, significantly raising voyage costs.

As a result, insuring the NSR is complex and leads marine insurers to apply stricter underwriting terms, including higher premiums, ice-class verification and seasonal limits.

Market impacts

Natural catastrophe losses globally have surpassed $100bn annually for the past five years. In the past decade, the APAC region has seen the highest number of marine losses of vessels over 100GT.

Premiums are rising for facilities located in typhoon zones or low-lying floodplains although ports that invest in climate resilience, such as elevated docks or storm gates, may receive adjusted rates. To address these risks, we are shifting from historical loss data to forward-looking risk models, incorporating sea-level projections, storm surge simulations and localised climate scenarios.

Traditional models do not fully incorporate evolving climate patterns, such as rising sea temperatures, shifting storm tracks, or compounding urban vulnerabilities. Moreover, data gaps in Southeast Asia hinder granular risk modelling.

Regulators in Singapore, Hong Kong and Australia now require insurers to integrate climate risks into solvency assessments and board-level reporting, and joint efforts by governments and industry are underway to deploy weather stations and digitise port risk portfolio. Additionally, industry consortia are supporting knowledge sharing and decarbonisation efforts. We partner with researchers to gather accurate data, refine models and help clients mitigate exposures.

Engineering and risk mitigation

Ports across APAC are engineering relevant infrastructure to mitigate extreme weather risks. For example, Singapore's Tuas Port has raised quay walls, retrofit drainage systems and relocated critical systems above flood levels. In anticipation of rising sea levels, Singapore's Terminal 5 airport is being constructed on reclaimed land, elevated up to 5.5 meters above sea level. Additionally, taxiways are designed with a slight slope to aid drainage and the drainage system is engineered to remain effective even as sea levels increase.

As a safety standard measure, most shipyards now implement real-time weather alerts and heat protocols, with hot work rescheduled to cooler periods. Regular safety drills ensure that port staff are prepared for typhoons and flooding events. Additional business continuity planning measures include backup routing, alternative berth arrangements and contingency power solutions.

On-site risk surveys for clients can identify pain points such as exposed control panels or unsecured container stacks. With a global footprint and deep regional insight, we are well-positioned to support APAC clients navigating both localised weather risks and international shipping challenges.

Shifting paradigm

As climate volatility continues to impact APAC's marine industry, marine insurance plays a pivotal role. Traditional models are quickly becoming inadequate to handle the pace and impact of emerging threats.

Insurers, underwriters and marine engineers must adapt by embedding climate science into risk models, incentivising resilience and supporting infrastructure upgrades.

We are committed to supporting the marine industry mitigate the challenges posed by climate volatility head on. In the wake of climate-related disruptions, our dedicated marine claims team ensures rapid response and recovery support, helping clients resume operations with minimal downtime.

With strategic collaboration, sound engineering and agile insurance tools, together we can keep ports operational, cargo protected and trade flowing.

This article first appeared on The Marine Insurer, October 2025.